Fire Damage Claim Adjuster

Obtain professional help from a private fire damage claim adjuster. A fire insurance adjuster will inspect, discover, and appraise your fire damage. Your fire damage claim adjuster will handle the filing, negotiating, and work on your behalf to secure the best chances for a successful fire claim settlement.

Schedule a Fire Damage Consultation

Have your fire damage claim questions answered for free. No sales pitch, No pressure. Just answers.

Fire Claims are Complex

Insurance agents will do anything possible to save their company money, even if it means short-changing, and low-balling you.

Ready to get 747% back?

With a professional, public adjuster on your side, you can do phenomenally better on your claim.

Don't Miss Anything

We have reviewed thousands of claims. We make sure nothing get’s missed, and you get what you deserve.

Fire damage claims are particularly complex for the insured, and usually expensive for the insurance companies.

Do not expect the insurance company to be very accommodating. For most fire claims, the insurer will thoroughly investigate the circumstances of the fire to prevent fire claim fraud, and take measures to minimize their losses.

The days following the fire are crucial for the positive outcome of your insurance claim.

It’s critical that you avoid:

Missing important deadlines, not understanding the terms of your insurance policy, making errors when completing the forms, or relying just on the appraisal put forth by your insurance company, may result in a smaller settlement, even a denied claim.

Work with a fire damage claim public adjuster from the start:

- to help discover and thoroughly appraise all the fire losses,

- file the insurance claim properly and on time,

- and negotiate with the insurance company.

You will secure the best chances for a successful fire claim settlement.

It will also leave you more time to deal with the other important aspects of your situation post-fire, and bring relief and peace of mind, knowing your claim is handled by qualified professionals.

Qualified Fire Damage Representatives

As insurance claim professionals since 1998, For The Public Adjusters has reviewed thousands of claims and have found that both insurance adjusters, policyholders, and contractors have unknowingly and will often miss hidden damages caused by fire. Not to mention, missed coverage you may be entitled to.

The fact is that in almost all instances, it is better to have a qualified, fire damage claim representative review your fire claim. Consider speaking with (and using!) a qualified fire damage claim expert who will be looking out for your best interests. You should speak with a public adjuster today (919) 400-6440.

After all, it’s free to simply speak with someone to get a feel for where you stand.

Fire damage claim tips

Help for homeowners and business owners that have suffered insurance property damage from fire or smoke.

Nearly all policyholders that have been associated with a fire loss in their home or business are likely to make really expensive mistakes before, during, and after the fire.

However, there is consistently one costly mistake that almost all policyholders make over and over, again and again.

It is such a simple concept that it is hard to believe that so many people fail to fully grasp that they have made this grave mistake.

What is the most costly fire insurance damage mistake?

Can you even imagine that most policyholders who have endured a devastating fire will depend solely upon the insurance company adjuster’s views and estimates of their damage?

Policyholders allow their insurance company’s adjuster to inspect their building, estimate and process their entire fire damage claim, and generate a value of their full fire insurance claim — without asking any questions. Without even considering if the insurance adjuster is correct!

Imagine policyholders that are doctors, lawyers, and accountants, willfully accepting the insurance adjuster’s own opinion without obtaining any comparisons, numbers from other contractors, or consulting a fire damage claim professional.

This is, without-a-doubt, the most costly mistake people will ever make in their entire life.

As if it’s not bad enough that your property was destroyed by fire damage, to then rely on someone else — who is not really there for you — to visit the property, inspect the damages, generate a biased valuation, and then completely trust that they have your best interest in mind. I’m sure you cn now see why you would need a fire insurance adjuster that represents YOU!

Why you should watch out for scams

Why You Must Deposit Your Claim Damage Checks

Get Your FREE Fire Report

The insurance company’s adjuster works directly for the insurance company. The fire damage Public Adjuster works directly for you!

You already made the correct choice by paying for a policy to protect your property, now it’s up to you to protect yourself.

Be sure you are properly compensated for the coverage and policy you paid for. Together, let’s review your fire damage claim file for free.

No sales pitch, no pressure, we just answer all your questions and advise you on where you stand both in damage and in coverage.

Educate yourself by finding out the “mathematics” of your claim. knowing where you stand will allow you to make an informed, educated decision on what to do next to protect yourself.

Fire damage claim tips for new or open fire claims

blank

Tip 1: Obtain Details Of Your Home Building

Tip 2: Document Your Belongings Damage

Tip 3: Review Of Your Policy

- How much coverage they have on their home or building.

- How much coverage is available for their contents (furniture, clothing, etc.).

- How much coverage they have to stay out of their home for hotels or to rent a business location, rental home or even rent furniture

Surprisingly, most policyholders have no idea about any of this basic information. Unfortunately, for most, their policy has been burned or damaged by the fire. In such instances, you can visit your agent and request a “certified true copy” of your full insurance policy and all its endorsements. It is also recommended to request that your agent explain how much coverage you have available in your policy.

Tip 4: Consult With A Professional

Fire Insurance CLaims Resources

Can A Public Adjuster Obtain Higher Compensation For Property Damage Claim

Insurers In General Will Always Try To Outwit You And Low-Ball Your Damage Claim There is a perception that most insurers try to outwit and outsmart their clients during the damage claim process. At the time of settlement from serious property damage claims like fire,...

Fire Claim Policyholder Burned By Insurance Process

Insurance Companies Require Written Inventory From Fire Claim Victims' Burned Homes The insurance company may only payout 30% of your fire claim damage when you have a total loss fire? How can that be? See this story from ABC News: [arve...

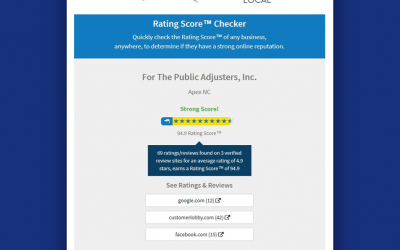

Top Rated Public Adjuster Reviews Receives 94.9% Rating Score For NC Claim Help

For The Public adjusters, Inc. of NC receives highest Public Adjuster Ratings for Public Adjuster Reviews from Top Rated Local. A search conducted through Top Rated Local's Score Checker shows For The Public adjusters, Inc. of NC has an overall average Review Rating...